Empower smarter

fraud detection

Comprehensive fraud detection powers smarter growth. Grow and protect your lending portfolio with industry-leading AI-powered fraud technology

Features to grow your lending by making your data work for you

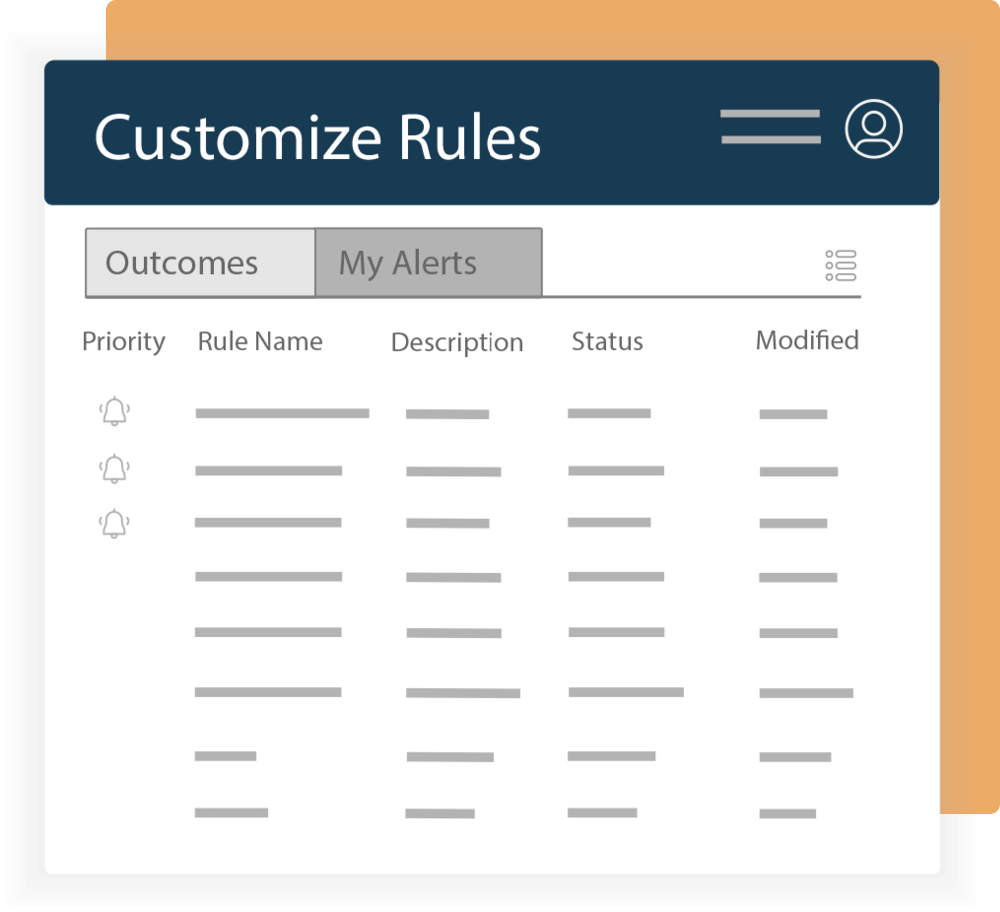

Customizable rules engine

Fraudsters are always evolving. You need a fraud mitigation platform that evolves even faster. Tailor your loan fraud detection by setting custom rules for different loan types, applicant profiles and risk levels.

And since the fraud landscape is constantly shifting, easily add, modify or disable rules as needed to respond to emerging threats without lengthy IT updates.

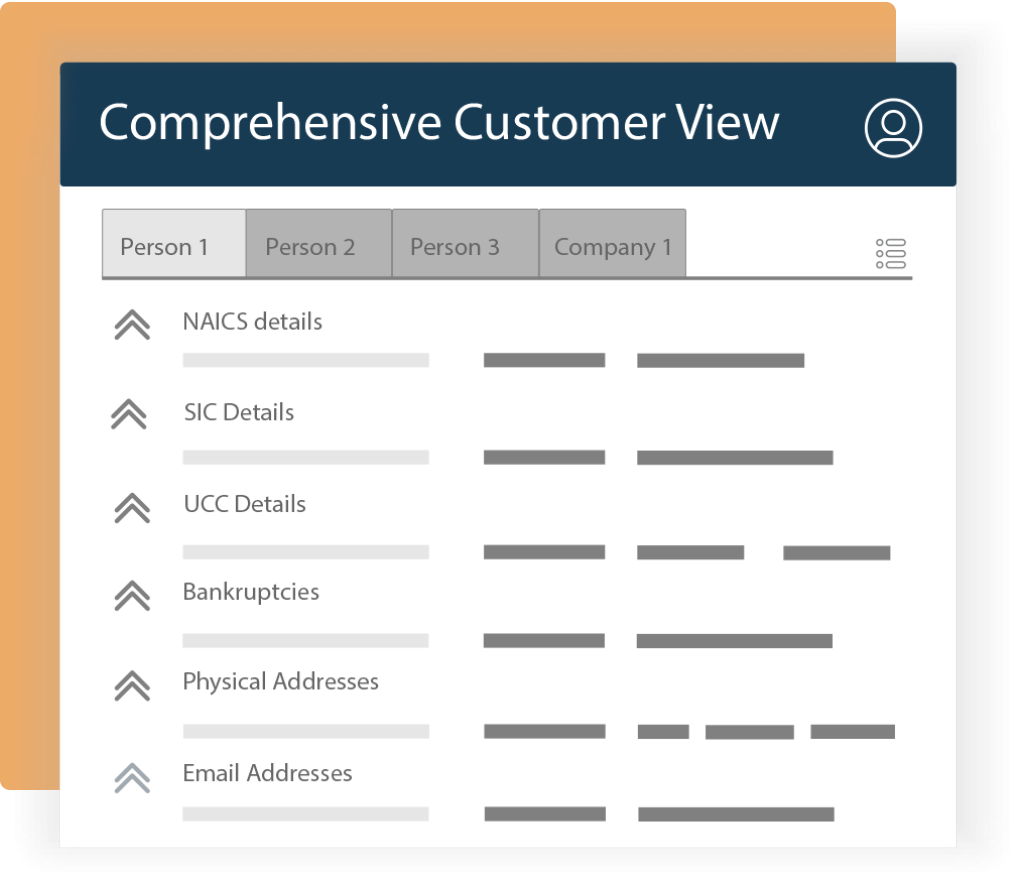

360 views of your customers

Our system ingests data from every corner of your organization—from customer profiles to account activity—and delivers a comprehensive view. Receive actionable insights during onboarding and beyond by leveraging your historical data and third-party data for informed lending decisions.

No more legwork to tie disparate data sources together. Now, you can access and act on the latest data from across the enterprise, enabling more informed lending decisions.

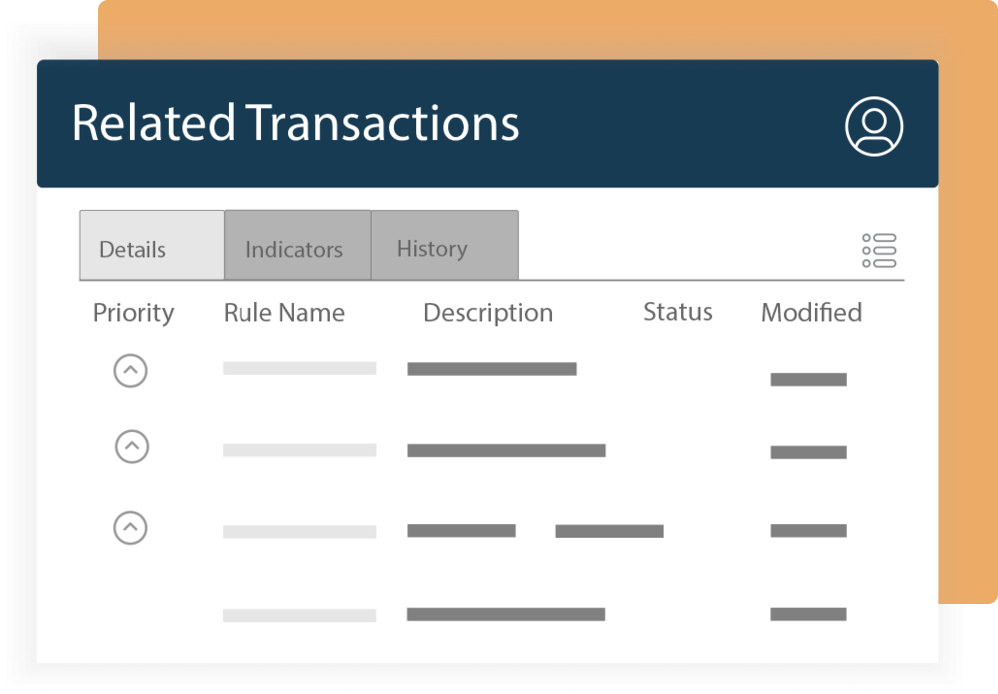

Real-time actionable insights gain

Gain real-time visibility into fraud trends and receive clear, actionable insights to inform approval decisions. Real-time insights during onboarding combined with third-party data sets help you make the right lending decisions.

With Lynx’s user-friendly interface, your team will be confident making the right decision in an ever-evolving threat landscape.

Robust fraud detection

Sophisticated algorithms identify and prevent fraud during the loan application process. Make data-driven lending decisions to safeguard your lending operations against sophisticated fraud rings.

Real-time analytics show suspicious patterns and activities, enabling prompt action and mitigation so you make better and more informed lending decisions.

Case Study: The value of Rapid Finance

How UBIZ modernized its lending operations and fueled growth with LoanPro and Rapid Finance

UBIZ tapped LoanPro and Rapid Finance to modernize its lending tech stack. Rapid Finance’s loan origination system (LOS), Decisioneer, was selected in combination with LoanPro’s modern lending and credit platform. The selection was easy since LoanPro and Decisioneer had a pre-built integration.

Take control of your data with Lynx

Utilize your data effectively to gain a comprehensive understanding of your customers and prospects, prevent fraud and enhance your lending processes.

Proactively detect fraudulent activities and patterns by leveraging our built-in AI features

Gain a comprehensive view of borrowers, adhering to KYC (Know Your Customer) and KYB (Know Your Business) guidelines for regulatory compliance.

Enhance portfolio monitoring by effectively using your data to gain insights into potential loan defaults.

Our latest news

Rapid Finance Expands Availability of Rapid Access Prepaid Mastercard® to All Business Line of Credit Clients

Rapid Finance, a leading small business financing platform helping small businesses find customized solutions, announced …

Read More

Live From Money20/20 Episode 1: Small Businesses and Banks Finally Closing the Gap

In a series of podcasts taped live at 2024’s Money 20/20 in Las Vegas, host …

Read More

Consumer data is weapon in business lending fraud battle by Will Tumulty

In an era of data-driven loan decisioning, bankers are working to better integrate and utilize …

Read More