Smarter Loan Origination. Built-in Revenue.

Decisioneer is a modern LOS for SMB lenders—streamlining applications, automating workflows, and generating non-interest income from declined loans.

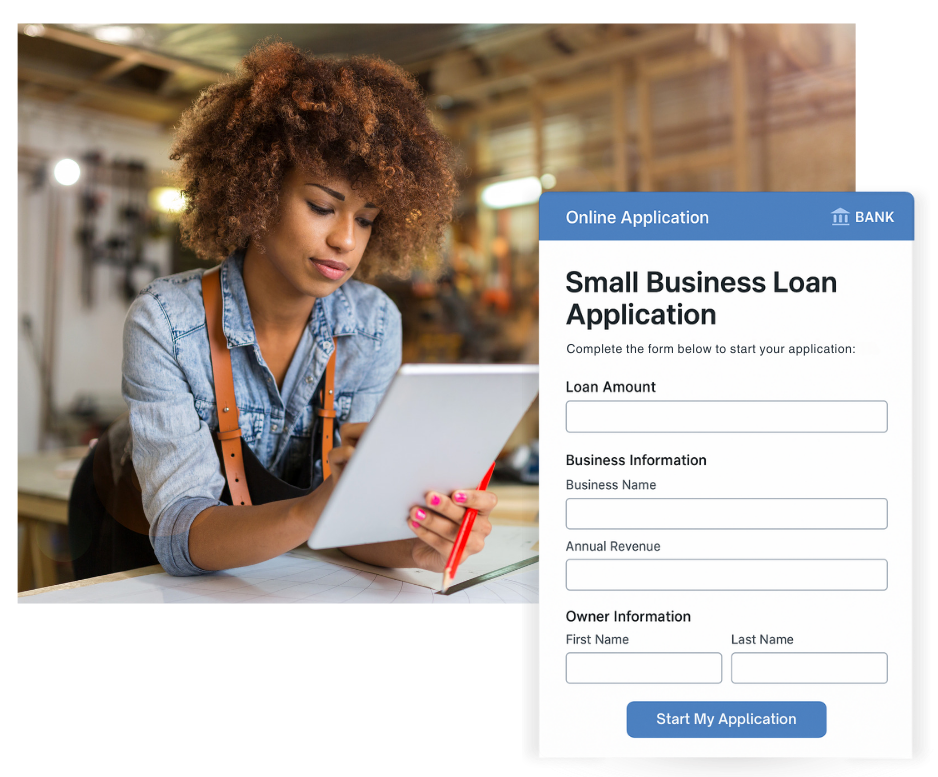

Streamline the loan origination process

Why choose Decisioneer?

- Deliver a seamless borrower experience: Digital applications, on-brand communication, and end-to-end transparency from first click to funding.

- Automate manual work: Configurable workflows reduce bottlenecks so your team processes loans faster with fewer resources.

- Make smarter decisions: Built-in scoring models and flexible decision rules enable consistent, data-driven approvals.

- Earn from declined applications: Route non-funded loans to a trusted referral network and capture new revenue streams.

- Keep it effortless: Referrals happen in-platform with no added burden on your team, preserving a seamless borrower journey.

Without Decisioneer

⚠️ Manual reviews slow processing and frustrate borrowers

⚠️ Declined applications generate no value and risk client churn

⚠️ Outdated systems create paper-heavy, clunky experiences

⚠️ Scaling requires heavy IT resources and added staff

With Decisioneer

✅ Automated workflows accelerate approvals and funding

✅ Declined loans routed to trusted partners generate referral revenue

✅ Flexible decisioning engine uses configurable rules to approve more qualified borrowers

✅ Cloud-based platform scales seamlessly with growth

Why SMB lenders need Decisioneer

Most loan origination systems weren’t built with small business lending in mind. Decisioneer is.

It’s designed to handle high volumes, quick decisions, and diverse borrower needs—without sacrificing compliance or customer experience.

With Decisioneer, your team can say “yes” more often, streamline workflows, and deliver funding faster, helping you build stronger relationships and scale with confidence.

Built-in Revenue Opportunities

Decisioneer → Rapid Funding Network → Revenue & Retention

-

Activate instantly: Enable the referral network directly in your LOS.

- Share seamlessly: Route non-funded applications to trusted partners in-flow, with no manual re-entry.

- Earn consistently: Receive referral fees for every loan funded, transforming declines into incremental revenue.

Built for Lenders, by Lenders

Decisioneer makes setup and daily operations simple so your team can focus on advising clients while the network expands your reach.

Small Business Lenders Need Decisioneer

-

SMB Lending Demand is Growing

-

Valuable Borrowers Slip Away

-

Digital Lending is the Standard

-

Intense Competition for Borrowers

SMB Lending Demand is Rising

Small businesses are applying for financing at record levels, yet many lenders struggle to process applications quickly and profitably. Decisioneer streamlines the origination process so you can capture more of this growing demand without overburdening your team.

Too Many Good Borrowers Slip Away

Traditional systems often lead to long decision times or outright declines when an application doesn’t fit perfectly into your credit box. Decisioneer helps lenders say “yes” faster to qualified borrowers—and creates revenue opportunities from referrals when you can’t fund the loan yourself.

Small businesses expect a paperless experience

Small business owners expect the same seamless digital experience they get as consumers—fast applications, mobile-friendly interfaces, and transparent communication. Decisioneer delivers a modern borrower journey that strengthens trust, improves satisfaction, and reduces application drop-offs.

Profitability is Hard to Maintain

Margins in small business lending can be thin, especially when application processing costs are high and approval rates are low. Decisioneer helps lenders grow profitably by reducing operational costs, enabling faster decisioning, and generating new revenue streams through loan referrals—so every application contributes to the bottom line.

Decisioneer set-up keeps your lending moving at the speed of business

Quick to implement

Designed for fast deployment, our cloud-based platform & plug-and-play integrations let you launch in weeks, not months.

Easy to configure

Customize decision rules, workflows, credit policies, and borrower experiences without the heavy IT lift.

Simple to Scale

Add new products or data sources as you grow, without disrupting operations.