Empower your team with a 360 view of your customer

Leverage third-party data integrations and intelligent data linking to reduce fraud & facilitate quick lending decisioning.

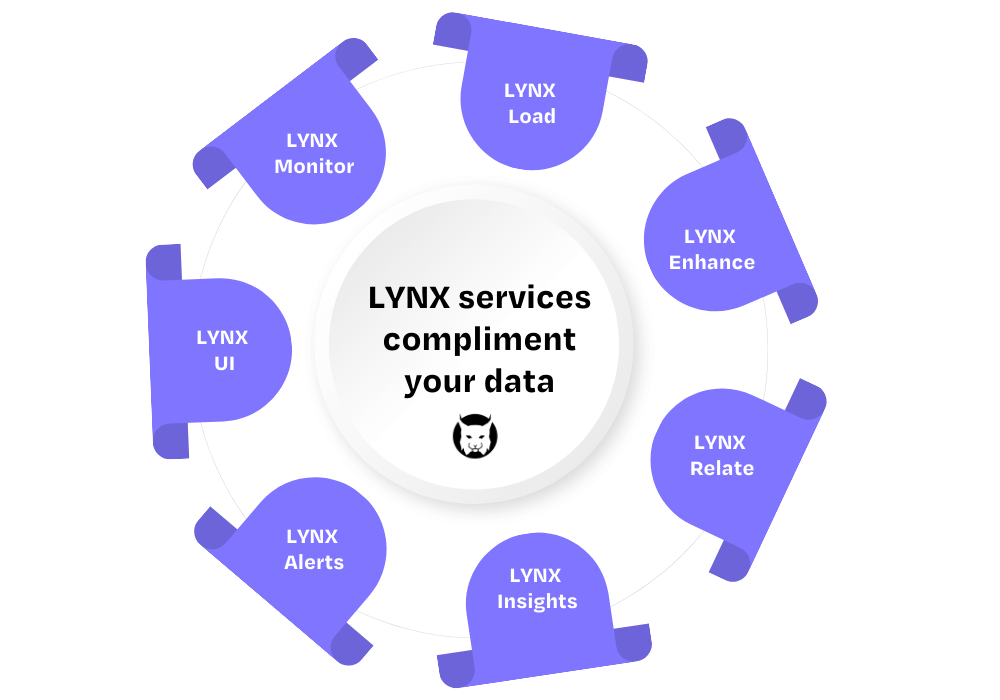

LYNX tools enable you to derive deeper insights

Automate Identity Check and Risk Mitigation with a single API.

With LYNX, lenders can leverage their data to make informed and timely decisions, minimize risk at origination and gather insights during servicing to gain a better ROI on your portfolio.

KEY DIFFERENTIATORS

Automate decisions and manage risk

Enrich and integrate cross business line data for 360 customer view and fraud mitigation.

Leverage our Network Alerts

With a network of meta data* and insights, we offer a better way to KYB your SMB customers.

*Meta data does not include any Lender/ FI specific data or PII

Make Informed Decisions

Leverage real-time data insights and automations to make sound origination decisions

Single View of Your Customer

Unify lifecycle and product views to get a 360 customer view, identify patterns and understand customer behavior

Monitor Risk in Real Time

Help to reduce credit losses by spotting risk sooner

Trust an Industry Leader

With Rapid Enterprise, we leverage our 18 years of SMB lending experience to bring you financial and technology solutions to launch or scale your SMB lending program.

Our value-added services integrate seamlessly into your lending lifecycle. Learn more today.

Let's Talk

Contact us to see how we can help achieve your business goals.

* indicates required fields